Napoleon’s formative years, the cost of climbing Mount Everest and how investment bonds work

Welcome back to ‘A Little Wiser’ newsletter. We hope everyone had a lovely weekend. Grab your coffee and let’s dive into today’s knowledge.👇

🎖️ Napoleon’s formative years

In a single decade, Napoleon Bonaparte transformed himself from an obscure artillery officer to ruler of the largest European empire since Charlemagne. Born on Corsica, he was a demographic anomaly among the French aristocracy at his military boarding school. Napoleon and his younger brother Louis shared a cramped room near the barracks, so small that Louis slept in a closet-like alcove on the floor. He survived on dry bread, brushed his threadbare uniforms to extend their life, and avoided cafés because he couldn't afford to settle his debts.

While his peers mastered courtly graces, the isolated Napoleon disappeared into books. At fifteen, his military school report described him as "Moody, overbearing and extremely egotistical, he prefers study to any kind of conversation. Much self-love and overweening ambition…" His notebooks from this period reveal a ferocious intellect at work, obsessively dissecting the political structures of Venice, the Arab world, and England. "I lived like a bear," he later recalled, "with books for my only friends." That solitary education paid dividends when the elite artillery corps held technical exams. While the wealthy cadets stumbled, the Corsican outsider passed effortlessly.

By the time he entered active service, Napoleon was ravenous for advancement and unshakably certain of his destiny. At twenty-four, he demonstrated unparalleled strategic insight, identifying a critical flaw in the British defenses that had escaped every senior officer. His subsequent, daring artillery plan forced the enemy fleet to abandon the Toulon harbor, a spectacular victory that instantly made him famous in Paris. The provincial outsider had just become France's most valuable officer.

The Young Napoleon Bonaparte Studying at the Military Academy at Brienne-le-Château

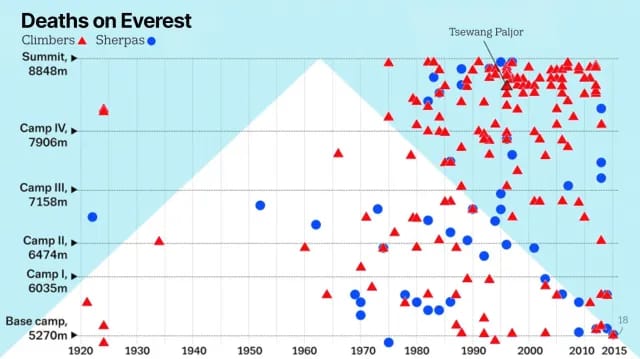

🏔️ The cost of climbing Mount Everest

Climbing Everest is one of the most expensive personal challenges a human can attempt. Before even reaching Base Camp, every climber faces three unavoidable costs: a $15,000 government permit, a liaison officer fee of roughly $3,000–$4,000 per team, and roughly $10,000 for the long approach to Base Camp including yaks, porters, and food. Only then do the real expenses begin. Budget expeditions run about $35,000–$45,000, usually with limited Sherpa support and older oxygen gear. Mid-tier teams charge $55,000–$75,000 for safer ratios and modern equipment. Top-end guided climbs with small groups, elite Sherpas and helicopter transfers often exceed $130,000. Before a climber even touches the mountain, they’ve invested thousands in training climbs, travel, and specialized gear. Everest has become a global industry, and every step above Base Camp is paid for several times over.

Yet, the financial cost is dwarfed by the physical one. The human body begins to fail at around 8,000 meters, the “death zone,” where oxygen levels drop to a third of what they are at sea level. Summit temperatures average –36°C (–33°F), and wind chill can plunge to –60°C (–76°F), enough to freeze exposed skin in minutes. Climbers rent oxygen for $500–$600 a cylinder and use five to eight on a typical summit push, yet even with this support they lose 8–12 kilograms over the expedition. Frostbite, fluid in the brain and fluid in the lungs remain the great killers. Over 200 bodies lie permanently on Everest’s upper slopes, many visible from the main routes as grim reminders that rescue is often impossible. Much of the mountain’s modern accessibility comes from the Icefall Doctors, an elite Sherpa team that installs more than 10 miles of fixed rope and aluminum ladders across the Khumbu Icefall each season. They make the route possible, long before any paying climber sets foot on it.

What makes Everest so paradoxical is that more people attempt it now than ever, yet the risks remain as lethal as in the 1950s. A climber has only a narrow 12-hour weather window to reach the summit and return safely. When hundreds converge at once, “traffic jams” form near the Hillary Step at 8,700 meters, forcing climbers to wait in a line while burning oxygen and freezing in place. Most aren’t elite athletes but determined amateurs with spreadsheets and savings. Success rates hover around 25 percent, and the fatality rate sits near 1–2 percent depending on the season. The money buys logistics, Sherpa expertise, and a chance, but never a guarantee. The final outcome is still a negotiation with an environment that does not care who you are or what you paid.

The Deadly Geography of Mount Everest

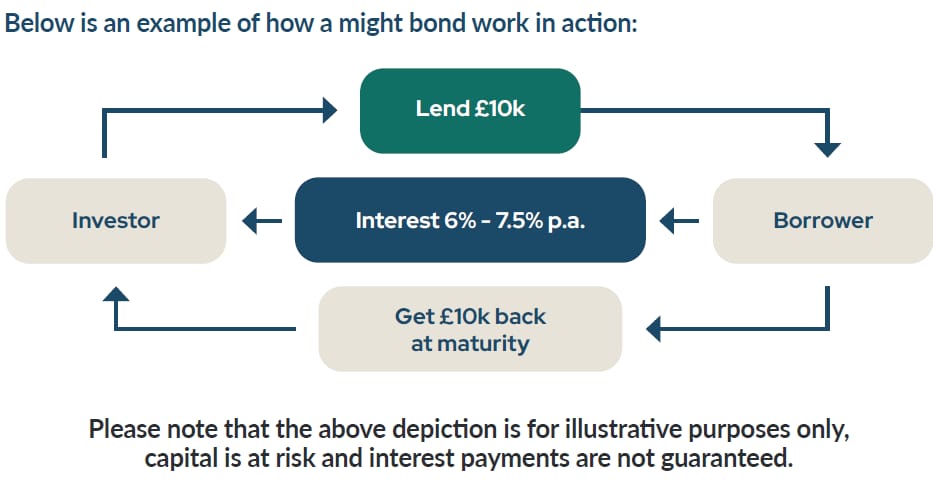

📈 How investment bonds work

If you’ve ever loaned money to a friend and expected them to pay you back later, you already understand the core idea behind bonds. A bond is simply a loan, but instead of lending to a friend, you’re lending to a government or a company. In return, they promise two things: regular interest payments (called coupons) and your full money back on a specific date in the future (called the maturity date). The name coupon comes from old paper bonds that literally had tear-off coupons you’d take to the bank for cash. If you buy a $1,000 bond with a 5% coupon, the borrower sends you $50 every year, like clockwork. It’s largely predictable and steady which is why it is referred to as fixed income.

There are three basic types of bonds you’ll hear about. Government bonds, like U.S. Treasuries, are considered the safest because the government can raise taxes or print money to pay you back. Corporate bonds are issued by companies and usually pay higher interest (a risk premium) because companies can fail. Municipal bonds (often called “munis”) come from cities or states and can even give you tax-free interest. No matter which type you buy, they all revolve around the same core idea that you lend money, you earn interest, and you get your money back later.

What makes bonds useful is how they behave in your financial life. While stocks bounce around wildly, bonds tend to be steadier because they’re based on the clear promises of set payments and a fixed end date. That’s why retirees often rely on them for predictable income, and why investors use them to balance out riskier assets. But bonds can still change in value. If interest rates rise, your older, lower-paying bond becomes less attractive and its price falls. If interest rates drop, your bond becomes more valuable. At its core, the bond market is nothing more than organized lending. Grasp this simple idea, and you will have mastered one of the most fundamental concepts in finance.

P.S. This is purely for intellectual understanding. Please don't mortgage your house and put the entire proceeds into Peruvian sovereign debt.

We hope you enjoyed today’s edition. Thank you to everyone reading, sharing, and helping A Little Wiser reach new people every week. We value every reader so please reply and tell us a lesson you’d love to see soon!

Until next time…. - A Little Wiser Team

🕮 Three lessons. Three times a week. Three minutes at a time.

💌 Enjoyed this edition? Share it with someone curious.